Simple Guidance for Business Owners & Private Companies

Accounting standards are essential guidelines that ensure your company’s financial reporting is consistent, transparent, and legally compliant. In Malaysia, these standards are issued by the Malaysian Accounting Standards Board (MASB)—the authority established under the Financial Reporting Act 1997 to oversee all accounting and financial reporting frameworks.

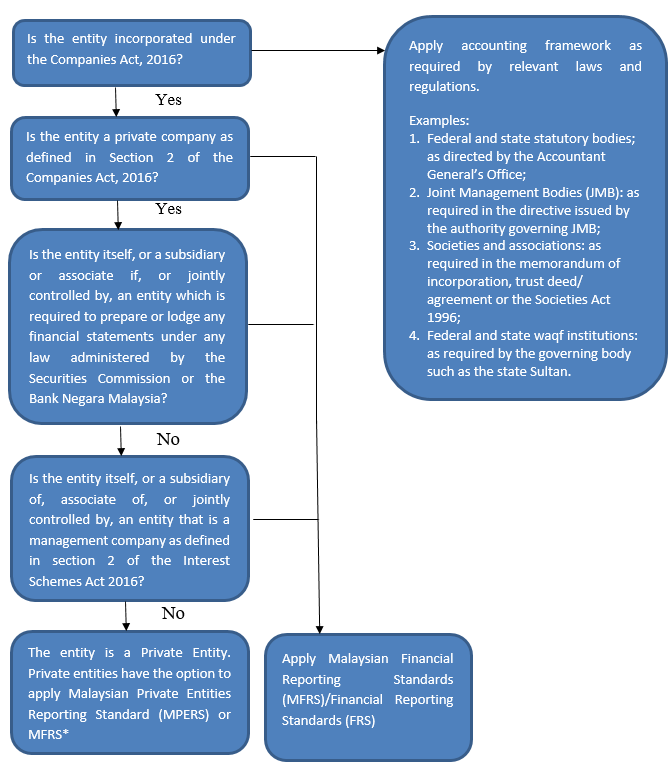

Depending on your business type, you’ll need to apply one of two sets of standards:

MASB Approved Accounting Standards for Entities Other Than Private Entities

MASB Approved Accounting Standards for Private Entities

Choosing the right framework depends on whether your company qualifies as a private entity. Here’s a simplified overview:

Is a private company under Section 2 of the Companies Act 2016

Is NOT required to submit financial statements under laws governed by Securities Commission or Bank Negara Malaysia

Is NOT a subsidiary, associate, or joint venture of a company that falls under those regulations

🛑 Exception:

Companies involved in management schemes under the Interest Schemes Act 2016 are not considered private entities, even if privately incorporated.

From 1 January 2018, all private entities that previously used FRS must switch to either:

MFRS (Malaysian Financial Reporting Standards), or

MPERS (Malaysian Private Entities Reporting Standard)

We are a professional accounting firm registered with the Malaysian Institute of Accountants (MIA). We provide full-service financial solutions to startups, SMEs, and established companies across Malaysia.

📊 Full Set of Accounts Preparation

📆 Monthly, Quarterly, or Annual Accounting (customized to your business volume)

🗣️ Closing Meetings with Insights & Recommendations

🧾 Payroll Calculation & Submission Services

Let our experienced team handle your accounting needs, so you can focus on growing your business.

📞 Contact us now for a consultation on the best framework and accounting support for your business.

Malaysia

Malaysia