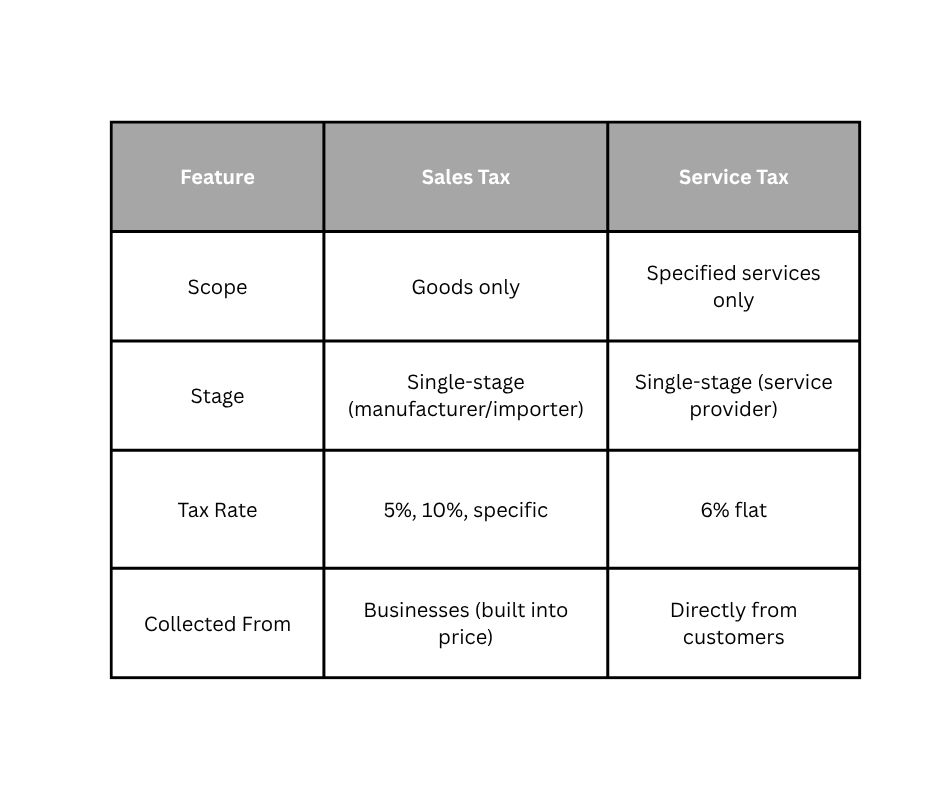

Any business in Malaysia, as well as its consumers, should be aware of the sales tax. The Sales Tax Act 2018 covers all taxable goods produced locally as well as those imported into Malaysia. Since it is charged only at the beginning, during manufacturing or importing, it differs from the Goods and Services Tax (GST) that was taken at each stage of business.

Here, we give you an in-depth explanation of sales tax in Malaysia, covering what is taxed, how much it costs, which items are exempt, how to register, your duties and pitfalls to stay away from.

Under the Sales Tax Act 2018, the Malaysian government has introduced a single-tier sales tax system after the GST was removed. It is only required for goods that are either manufactured here in Malaysia or imported. Services do not face taxes on sales.

The Royal Malaysian Customs Department governs and oversees sales tax, takes care of checks and inspections and ensures audits and enforcement.

Key Characteristics of Sales Tax

These additional fees apply at the following percentage levels:

Specific goods are taxed for the amount of goods transported, rather than how expensive they are.

Goods need to be categorized using the Customs Duties Order to find the correct paying rates for manufacturers and importers.

Some products are exempted by the Sales Tax (Exemption) Order 2018.

Because Malaysia uses destination-based taxation, goods going abroad are given zero tax.

Businesses in the manufacturing sector are to register for sales tax if their taxable sales during the year exceed RM500,000. It applies to businesses that are involved in assembly, packaging, bottling or processing of any kind.

A business that falls below the required income can still register as it chooses.

Registered people involved in manufacturing or importing must:

Ignoring tax deadlines results in both fines and possible legal consequences.

At entry into the country, Malaysian Customs calculates the sales tax on imports. The duty is worked out by adding in the import duties to the CIF price. If the product’s HS Code is applied correctly, customs taxation will be accurate.

Though consumers do not make sales tax payments, it is built into the cost of what they buy from stores. The additional cost of dealing with cargo moves from the initial supplier through the supply chain to the end user.

Still, getting them exempt or keeping prices low on essential goods keeps them from paying taxes on things they need.

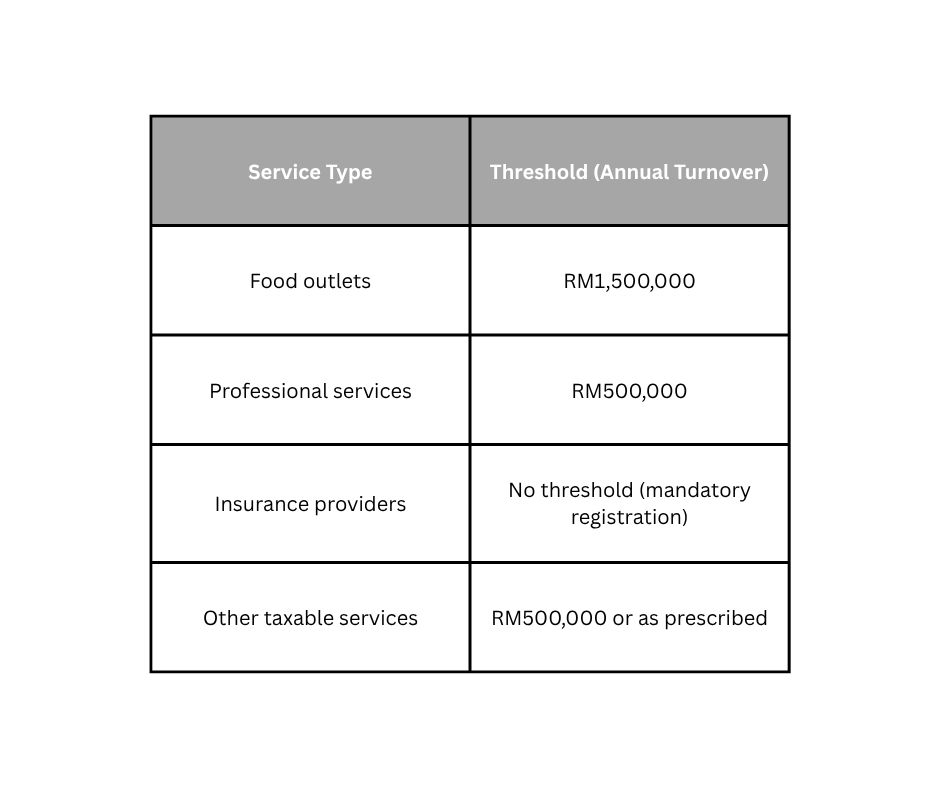

Malaysia imposes Service Tax, a special type of indirect tax controlled by the Service Tax Act 2018. GST is paid by taxable individuals for certain services they give to customers in Malaysia.

Service tax is imposed only on services that are mentioned in the law. It is not allowed on any service that is not considered a “taxable service”.

Subject to tax are the following services:

For instance:

An extra charge for service tax can be seen on invoices and receipts. You will charged with the 6% tax at dining or when you pay an accountant.

Because service tax is paid by those who buy, it is better understood than sales tax which is borne by sellers.

For More Information and Official References:

General Guide – Service Tax (latest consolidated version):

Download PDF

The new sales tax rate change takes effect on 1 July 2025.

The list of goods affected by the sales tax rate change is as follows:

i. the rate of 5% and specific rates can be referred to under the Sales Tax (Rate of Tax) Order 2025.

ii. the exempted goods can be referred to under the Sales Tax (Goods Exempted from Tax) Order 2025.

If the goods are not listed in either of the above orders, the tax rate on the goods is subject to 10%. Both orders can be accessed at the following link https://mysst.customs.gov.my/.

Based on Section 3 of the Sales Tax Act 2018, the definition of manufacturing is the manual or mechanical transformation of organic or non-organic materials into a new product by altering the size, shape, composition, nature, or quality of those materials. It also includes the assembly of parts into machinery or other products, but does not include the assembly of machinery or equipment for construction purposes. For further inquiries, the company can refer to the Internal Tax Division in the respective state.

Yes, your company is required to be registered under Section 13 of the Sales Tax Act 2018 if the total value of taxable goods sold exceeds the threshold amount of RM500,000 within a 12 months.

Registration may be completed online via the MySST system. Upon successful registration, a notification will be sent to the email address provided during the registration process.

Voluntary registration is permitted under Section 14 of the Sales Tax Act 2018, provided that you are engaged in the manufacturing of taxable goods and the total value has not reached the threshold amount of RM500,000.00.

You may obtain confirmation of the tariff code from the Technical Services Division of the relevant State.

Once the tariff code has been confirmed, you can refer to the sales tax rate through the Sales Tax Order (Tax Rate) 2025 and the Sales Tax (Exempted Goods from Tax) Order 2025. The updated sales tax rate can be found under the Sales Tax (Tax Rate) Order 2025 on the MySST portal at https://mysst.customs.gov.my/. If the tariff code for the goods is not listed in the aforementioned orders, the sales tax rate applicable to those goods shall be 10%. Any further inquiries, please refer to the Domestic Tax Division at the relevant State.

Yes, the imported goods will be subject to the applicable new sales tax rate when they are released from Customs control by the authorized Customs officer. The importation of goods into Malaysia must be declared on Customs Form No. 1 (K1). For taxable goods, the sales tax applicable is paid through the submission of Form K1.

As a registered manufacturer, you are eligible to purchase raw materials, components, packing and packaging materials, manufacturing aids, and cleanroom equipment exempt from sales tax. You may apply for a sales tax exemption under the Sales Tax (Persons Exempted from Payment of Tax) Order 2018, subject to the conditions outlined in the details and the order itself. Applications for the sales tax exemption certificate can be submitted online via the portal at https://mysst.customs.gov.my/. The manual for applying for the sales tax exemption certificate is available for reference https://mysst.customs.gov.my/AboutExemption

Your company is required to register as a registered manufacturer under Section 13 or 14 of the Sales Tax Act 2018 to charge sales tax on the manufactured goods starting from the effective date of the registration approval letter.

Philippines

Philippines